The US Federal Reserve is widely expected to cut interest rates by a quarter percentage point at its upcoming December 17-18 meeting, Reuters reports.

However, attention is shifting to the Fed’s updated economic projections, which will offer insight into its approach to interest rate policy through 2025 and beyond.

With inflation proving more persistent than anticipated and the labor market showing unexpected strength, Fed officials are expected to take a more cautious stance on future rate cuts. Analysts suggest the central bank may signal a slower pace of reductions in borrowing costs compared to expectations from earlier this year.

Investors have already priced in a 0.25 percentage point rate cut at the December meeting. This reduction would bring the policy rate down from its current range of 4.50% to 4.75%. However, the primary focus will be on the Fed’s “dot plot” — a chart that reveals individual policymakers’ interest rate projections for the coming years.

The Fed’s rate path for 2025 and potentially 2026 is of particular interest. Policymakers will have to balance competing economic signals, including inflation that remains above target, a surprisingly resilient labor market, and the potential impacts of geopolitical risks and US political shifts following the 2024 presidential election.

Inflation has eased from its pandemic-era highs but remains “sticky,” with mixed signals in key inflation measures. While housing costs have moderated and the Personal Consumption Expenditures (PCE) Price Index — the Fed’s preferred inflation gauge — is expected to post a low reading for November, these figures won’t be available until two days after the Fed’s meeting concludes.

Policymakers are looking for clear signs of sustained disinflation, but the overall pace of price growth has been slower than anticipated. Fed officials are cautious about committing to too many future rate cuts, as they want to ensure inflation is firmly on track to hit their 2% target.

The labor market has defied predictions of a major slowdown. While the unemployment rate has ticked up slightly to 4.2%, it remains below the national long-term average and matches the Fed’s definition of “full employment.” Job growth has cooled from its earlier rapid pace, but it is still viewed as stable.

For the Fed, this resilience presents a dilemma. On one hand, it suggests the economy is strong enough to handle further rate cuts. On the other hand, if the labor market is running at or near full capacity, cutting rates too far could spur consumer demand, stretch the economy’s production capacity, and reignite inflationary pressures. This is one reason Fed officials are expected to take a “measured approach” to future rate cuts.

Wage growth has been a key concern for inflation, but recent data indicates that rising productivity is helping to offset wage pressures. Unit labor costs, a measure of labor costs relative to business output, have been increasing at a more manageable pace, suggesting that businesses are becoming more efficient.

This development may offer the Fed some breathing room. While strong wage growth often fuels inflation, improved productivity can counterbalance those effects. If these trends continue, it could make policymakers more comfortable with further rate cuts.

Despite higher borrowing costs and a shift back to pre-pandemic spending patterns, consumer demand remains solid. As long as people remain employed and wages continue to grow, consumer spending — a key driver of economic growth — is unlikely to slow significantly.

Robust consumer demand has underpinned the Fed’s efforts to achieve a “soft landing,” in which inflation is brought under control without causing a recession. However, it also raises concerns that cutting rates too aggressively could encourage excess consumer spending, potentially reversing progress on inflation.

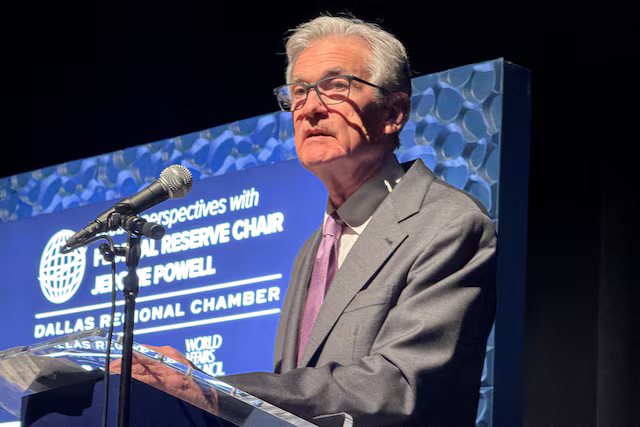

When Fed Chair Jerome Powell delivers his post-meeting press conference, markets will be listening closely for signals about the future pace of rate cuts. Analysts predict Powell will emphasize caution and highlight the Fed’s data-dependent approach. The updated “dot plot” is expected to show a slower and more deliberate path of rate reductions, especially for 2025 and beyond.

This shift would mark a more hawkish tone from the Fed compared to earlier this year, when multiple rate cuts were seen as more likely. But with inflation still elevated, consumer demand strong, and the labor market stable, the central bank may prefer to tread carefully in case conditions shift unexpectedly.