Nvidia’s upcoming earnings report on Wednesday is expected to be a focal point for investors, with the company at the forefront of powering the artificial intelligence (AI) revolution.

As the chipmaker prepares to share its fiscal third-quarter results, all eyes will be on its progress amid skyrocketing demand for AI-related products.

Last quarter, Nvidia delivered impressive results, with both sales and earnings more than doubling compared to the previous year. Despite the positive performance, the stock dropped by about 6% in the aftermath, as concerns arose over profit margins and the sustainability of the tech industry’s heavy reliance on Nvidia’s chips. However, any skepticism was short-lived, and Nvidia’s stock quickly resumed its upward trajectory. The shares have nearly tripled this year, following a massive threefold gain in 2023.

For this quarter, analysts are projecting strong growth for Nvidia. Consensus estimates compiled by FactSet forecast sales of $33.15 billion, a 10% increase from the previous quarter and nearly double the amount from a year earlier. Net income is expected to reach $17.43 billion, up from $16.6 billion in the last quarter and significantly higher than $9.24 billion in the same period last year.

A major factor driving Nvidia’s growth is its next-generation Blackwell chips, which are seen as pivotal to the company’s future prospects. Analysts anticipate that the Blackwell family of products will generate nearly $63 billion in revenue for the next fiscal year, a dramatic jump from just $4 billion this year. T. Rowe Price’s Dominic Rizzo echoed the sentiment, describing demand for the Blackwell chips as “absolutely insane.”

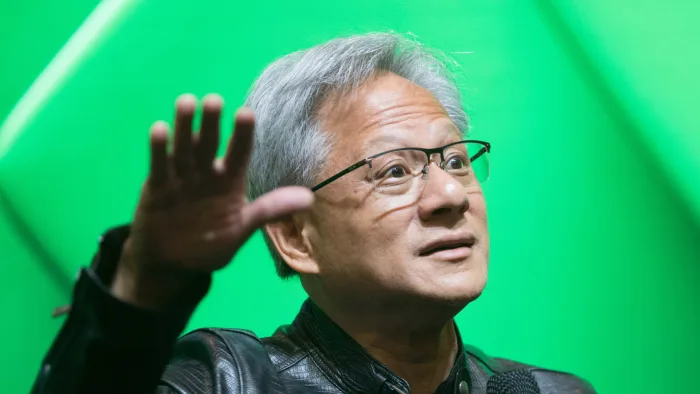

Nvidia’s CEO, Jensen Huang, has emphasized the immense demand for Blackwell chips, which are reportedly two and a half times faster than the company’s previous H100 chips for training AI models like OpenAI’s ChatGPT. When used for real-world applications, such as inferencing, Blackwell chips are said to be five times faster.

Despite the excitement surrounding Nvidia’s chip offerings, there have been some challenges. A recent report highlighted overheating issues with Blackwell chips when installed in high-capacity server racks, leading to concerns over potential delays in deploying the chips in AI data centers. This has raised questions about Nvidia’s ability to meet the surging demand for its products.

Nonetheless, investors remain bullish on the company. Nvidia, which controls nearly 80% of the market for high-end AI chips, continues to secure major customers, including Google, Microsoft, and Tesla. Many analysts are optimistic about the company’s outlook, with firms like Truist and Stifel raising their price targets ahead of the earnings report. Truist raised its target from $148 to $167, while Stifel bumped up its price target from $165 to $180, citing strong growth prospects driven by Blackwell chips and AI infrastructure investments.

While Nvidia’s position in the AI chip market remains dominant, some analysts are cautious about the potential for margin contraction as the company ramps up production. With a strong backlog and rising demand for AI infrastructure, Nvidia is likely to maintain its growth trajectory, but analysts are mindful of broader economic factors, including the possibility of a slowdown in tech investment.

With input from the Street and the Wall Street Journal.