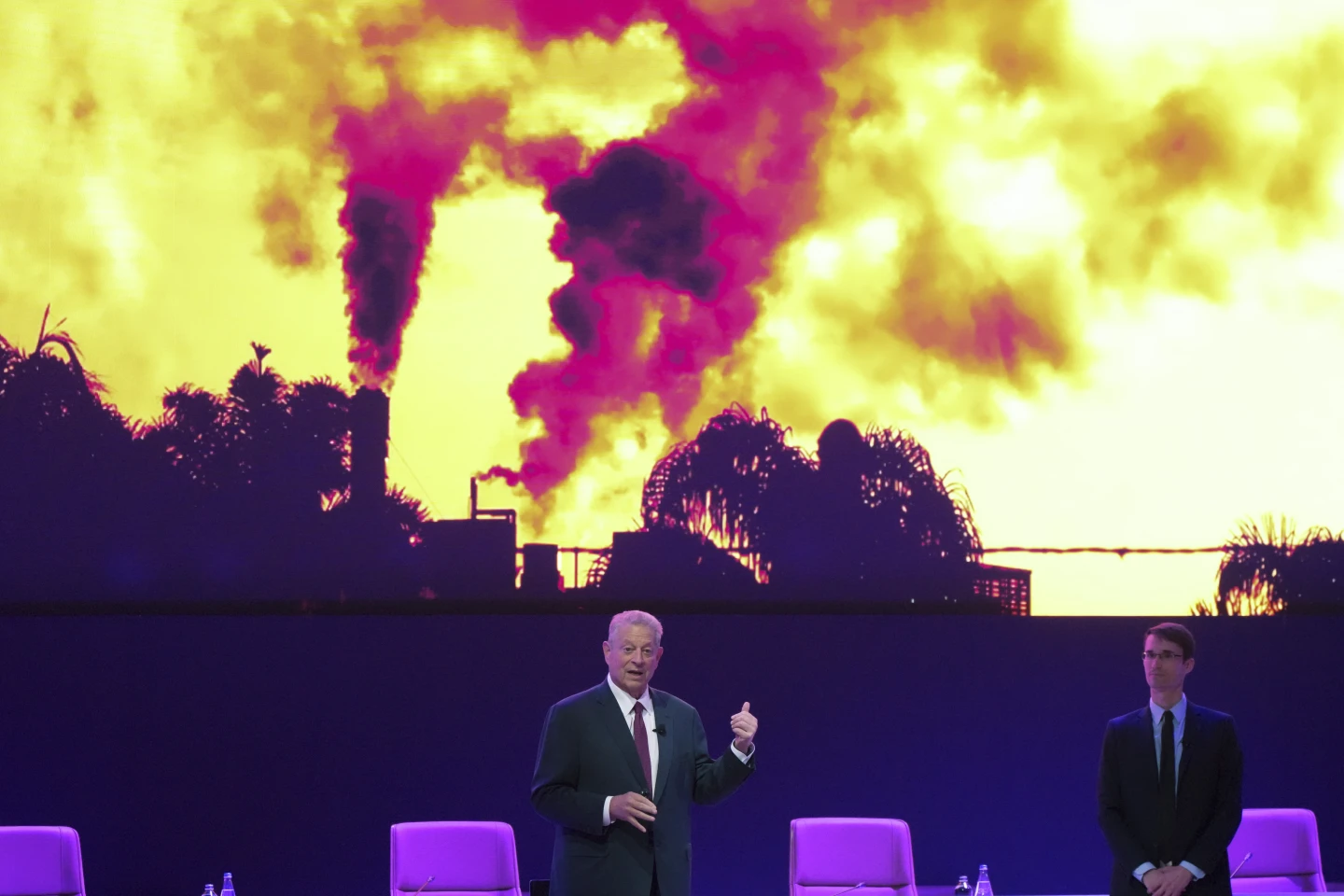

China’s steel and oil refining sectors are grappling with significant financial losses as the country’s economic slowdown continues to weigh on demand, while recent government stimulus measures are being closely monitored for potential relief.

With the latest data from China’s National Bureau of Statistics showing cumulative losses of 34 billion yuan ($5 billion) in the steel industry and 32 billion yuan in oil refining over the first nine months of 2023, these sectors face mounting challenges as they adapt to a shifting economy.

Steelmakers have been compelled to scale back production to protect shrinking profit margins impacted by the prolonged downturn in China’s property sector. The risk of bankruptcy looms for some steel mills, and ongoing weaknesses in the sector are evident as industrial profits overall have continued to decline, falling 27.1% year-over-year in September—marking the sharpest drop since the pandemic onset in 2020.

The oil refining industry faces similar pressures as demand for fuel remains low, exacerbated by the country’s rapid uptake of electric vehicles, which has curbed the need for traditional fuels. In response, oil refineries have cut back production rates, joining steel mills in their efforts to minimize losses. According to Goldman Sachs, oil consumption could see a limited boost under new economic measures, but with the government’s emphasis on clearing unsold housing rather than stimulating new construction, the positive impact on the steel sector may be constrained.

Beyond steel and oil, other commodities sectors have also seen earnings slide. Coal mining profits fell by 22% this year, as an oversupply of coal impacted prices, while chemical producers, reliant on fossil fuels for production, recorded a 4% decrease in income.

Despite the economic strain, some investors are optimistic about China’s commodity markets, particularly copper, with expectations of industry expansion in 2024-2025 shared during the recent Shanghai Metals Market conference. Meanwhile, China’s official manufacturing purchasing managers’ index (PMI) for October, due for release Thursday, is expected to indicate slight growth in factory activity, with a projected reading of 50.1.

Beijing has responded to recent economic pressures with a series of stimulus initiatives, with additional fiscal measures anticipated following next month’s National People’s Congress meeting. Policymakers are aiming to reach a 2024 growth target of around 5%, having achieved a 4.8% expansion through the first three quarters of this year.

Economists suggest that while the nation’s supply-side policies are essential, China’s economy may increasingly benefit from demand-side support to help stabilize sectors struggling under the weight of weak domestic demand and deflationary pressures.