Nippon Steel’s ambitious $15 billion bid to acquire US Steel encountered significant hurdles as the deal faced increasing scrutiny from US regulators and political figures, Reuters reports.

The acquisition, which seemed promising, was complicated by warnings from the Committee on Foreign Investment in the United States (CFIUS) and broader political concerns.

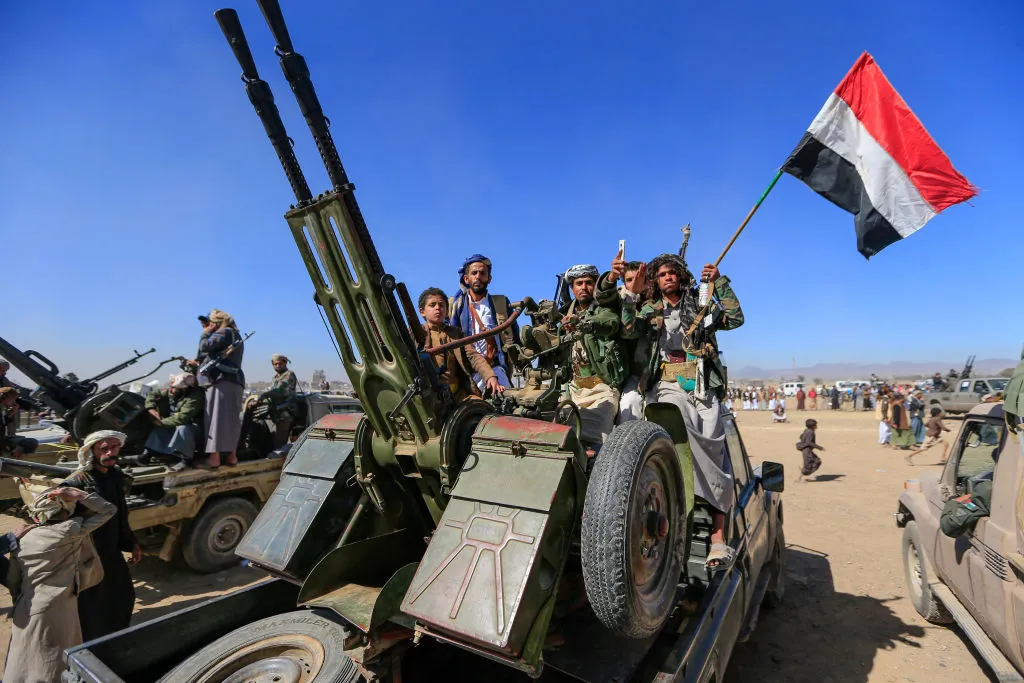

A month before Nippon Steel’s bid was on the verge of being thwarted by President Joe Biden, the Japanese steelmaker received a critical alert from CFIUS. On August 1, officials from the committee raised concerns about the potential national security risks associated with the deal. They suggested that the merger could negatively impact US steel production capacity, potentially disrupting key industries like transportation and infrastructure.

Despite this warning, Nippon Steel hoped to secure approval by emphasizing the economic benefits of its investment, including plans to refurbish US Steel’s facilities with $1.3 billion. The company believed that by presenting its case and engaging with stakeholders, including labor unions, it could overcome the regulatory obstacles.

However, on August 31, CFIUS issued a detailed 17-page letter outlining its concerns and granting the companies only one business day to respond. The short timeframe and the nature of the concerns indicated that the bid was facing serious challenges. Reports soon emerged that President Biden was likely to block the acquisition.

Nippon Steel had initially attempted to engage with the United Steelworkers (USW) union before the deal’s public announcement. The company had requested a meeting with the union on November 20, but the request was declined, partly due to concerns about maintaining the confidentiality of the competitive bidding process. When the bid was announced on December 18, USW leaders criticized the deal, accusing US Steel of disregarding workers’ interests and urging the US government to scrutinize the transaction.

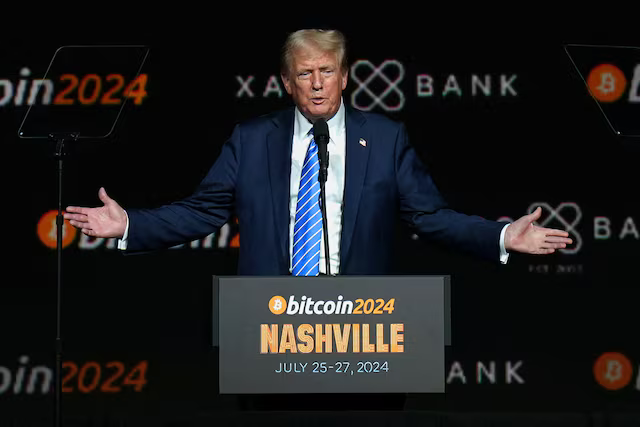

The political climate further complicated the situation, with both President Biden and his Republican rival, Donald Trump, expressing opposition to the deal. During Japanese Prime Minister Fumio Kishida’s state visit to Washington, the acquisition was a notable topic of discussion, though Nippon Steel’s executives were not among the prominent guests at a White House dinner.

In the weeks leading up to the August 31 CFIUS letter, Nippon Steel remained optimistic that the political pressure would eventually ease, allowing the deal to proceed. The company believed that after the elections, the administration would reconsider the economic merits of the acquisition. However, the subsequent CFIUS letter, which provided little opportunity for negotiation, signaled a potentially insurmountable obstacle.

Nippon Steel and US Steel responded with a comprehensive 100-page letter, addressing factual inaccuracies and proposing mitigation measures. Despite these efforts, the deal’s prospects appeared bleak as news surfaced that the White House was poised to block the acquisition.

Experts suggest that Nippon Steel’s experience serves as a case study in the complexities of navigating political and regulatory landscapes in major international transactions. David Boling, a former US trade official, remarked that the deal may become a textbook example of how misreading political dynamics can impact business negotiations.