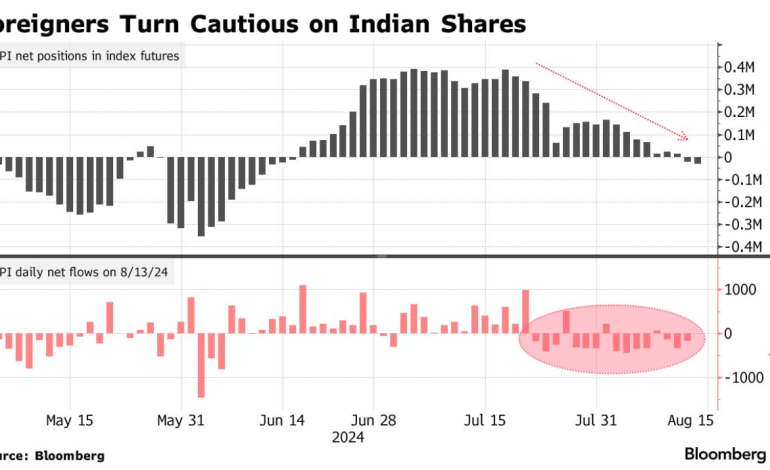

Foreign investors are growing increasingly cautious about Indian shares, with enthusiasm waning as the market faces increasing volatility, lukewarm earnings, and a surprise tax hike on equities, Bloomberg reports.

Global funds have turned bearish on Indian stocks for the first time in two months, with net shorts of 30,547 index futures as of Wednesday’s close. Just a month ago, large investors abroad were net long about 400,000 contracts, their most bullish stance since 2015.

That’s happening just as foreign portfolio investors — or FPIs — have been selling in the cash market. They’ve offloaded almost $2 billion net of Indian equities this month through Aug. 13, after adding more than $6 billion in June and July.

Following trong rally that boosted the NSE Nifty 50 Index by 15% this year, foreign investors express concerns over valuations in the Indian stock market, particularly as global volatility spikes. While the Nifty 50 has retreated slightly from its peak, it still trades at a significant premium, with its price-to-earnings ratio exceeding 20 times estimated earnings for the next 12 months. This is up from around 18 times in October, indicating a potential overvaluation, according to the report.